bushiken.ru

Gainers & Losers

Car Loan Apr Rates

Check out our car loan rates · New Car Loan. As low as. %A P RAPR. on a month term Available for or newer models; Terms from 36 to 84 months · Used. Restrictions may apply and offer subject to change without notice. Payment examples: Loan amount of $20, at a rate of % APR for 36 months would have. Shopping for a New or Used Car? Auto loan rates as low as % APR for new vehicles. Apply Nowfor an auto loan. Today's New & Used Car Loan Rates. Example monthly payments per $1, $ for 12 months at % APR, $ for 24 months at % APR, $ for 36 months at % APR, $ for Used Vehicle Loans ; 36 Months · % · % ; 48 Months · % · % ; Months · % · % ; Months · % · % ; 84 Months · % · %. Auto Loan Rates Effective date: September 1, ; 73 - 84 months. % - %, $ - $ ; 24 - 36 months. % - %. $ - $ As of , the average interest rate for car loans was percent for new cars and percent for used cars. A credit union car loan that puts you in the driver's seat ; New Vehicle Rate, % APR ; Used Vehicle Rate, % APR ; Vehicle Refinance, % APR ; Used. Apply for auto financing today. The rate calculator provides estimated auto financing terms, APRs and monthly payment amounts. Check out our car loan rates · New Car Loan. As low as. %A P RAPR. on a month term Available for or newer models; Terms from 36 to 84 months · Used. Restrictions may apply and offer subject to change without notice. Payment examples: Loan amount of $20, at a rate of % APR for 36 months would have. Shopping for a New or Used Car? Auto loan rates as low as % APR for new vehicles. Apply Nowfor an auto loan. Today's New & Used Car Loan Rates. Example monthly payments per $1, $ for 12 months at % APR, $ for 24 months at % APR, $ for 36 months at % APR, $ for Used Vehicle Loans ; 36 Months · % · % ; 48 Months · % · % ; Months · % · % ; Months · % · % ; 84 Months · % · %. Auto Loan Rates Effective date: September 1, ; 73 - 84 months. % - %, $ - $ ; 24 - 36 months. % - %. $ - $ As of , the average interest rate for car loans was percent for new cars and percent for used cars. A credit union car loan that puts you in the driver's seat ; New Vehicle Rate, % APR ; Used Vehicle Rate, % APR ; Vehicle Refinance, % APR ; Used. Apply for auto financing today. The rate calculator provides estimated auto financing terms, APRs and monthly payment amounts.

Auto Loan Rates & More ; Auto Loan Rates (New) · APR · Auto and Truck (new). Months, %% ; Auto Loan Rates (used) · APR · Auto and Truck (used). Auto Loan Rates as Low as % APR for New Vehicles You could get a decision in seconds, plus a discount for active duty and retired military. Whether you'. Example rate of % APR with 36 monthly payments = $ per $1, borrowed, loan to value Auto loan requires a minimum. Used Auto Rates ; N/A, % – %, $ – $ ; $10,, % – %, $ – $ Southeast Financial Credit Union: Best for short-term car loans. Southeast Financial Credit Union logo. Starting APR. %. Loan terms. 7-year auto loans, rates as low as % APR, Star One Credit Union. Auto Loan Rates ; New Auto , %, %, %, % ; Used Auto , %, %, %, % ; Used Auto , %, %, %, -. Car loan APRs range from % APR to % APR when you use Auto Pay. Ready to apply? Finance new or pre-. APR = Annual Percentage Rate. Rates are subject to credit approval and shown are “as low as”. APRs range based on factors including transaction type, loan term. *Annual Percentage Rate (APR) is based on an interest rate of % for qualified borrowers and on Model Years and newer. Loan APR is based on a loan. August Car Loan Rates (APR) in the U.S. for Used and New Cars · 9% - % · 10% - % · 11% - % · >12%. “In the fourth quarter of , the overall average auto loan interest rate was % for new cars and % for used cars.” https://www. New Auto Loan Rates ; 36 months, %, $ ; 48 months, %, $ ; 60 months, %, $ ; 72 months, %, $ Additional rate and financing conditions apply for new and used auto and truck loans $, and greater. Rates are 1% higher without AutoPay; maximum %. There is a $49 Processing Fee on all new auto loans ( and newer). There is a $ Processing Fee on all used auto loans ( and older). Best Credit. New & Used Auto Loans ; % - % APR · % - % APR · $ - $ Interest rates change all the time. However, an average interest rate on a car loan for people with bad credit has been %. APR = Annual Percentage Rate. Rates are subject to credit approval and shown are “as low as”. APRs range based on factors including transaction type, loan term. AUTO LOAN RATES ; Up to 36 Months, $5,$,, % ; Months, $10,$,, % ; Months, $15,$,, % ; Months, $20,$. New Auto Loan Rates ; 36 - 63 Months, % - % ; 64 - 72 Months, % - % ; 73 - 84 Months, % - % ; 85 - 96 Months, % - %.

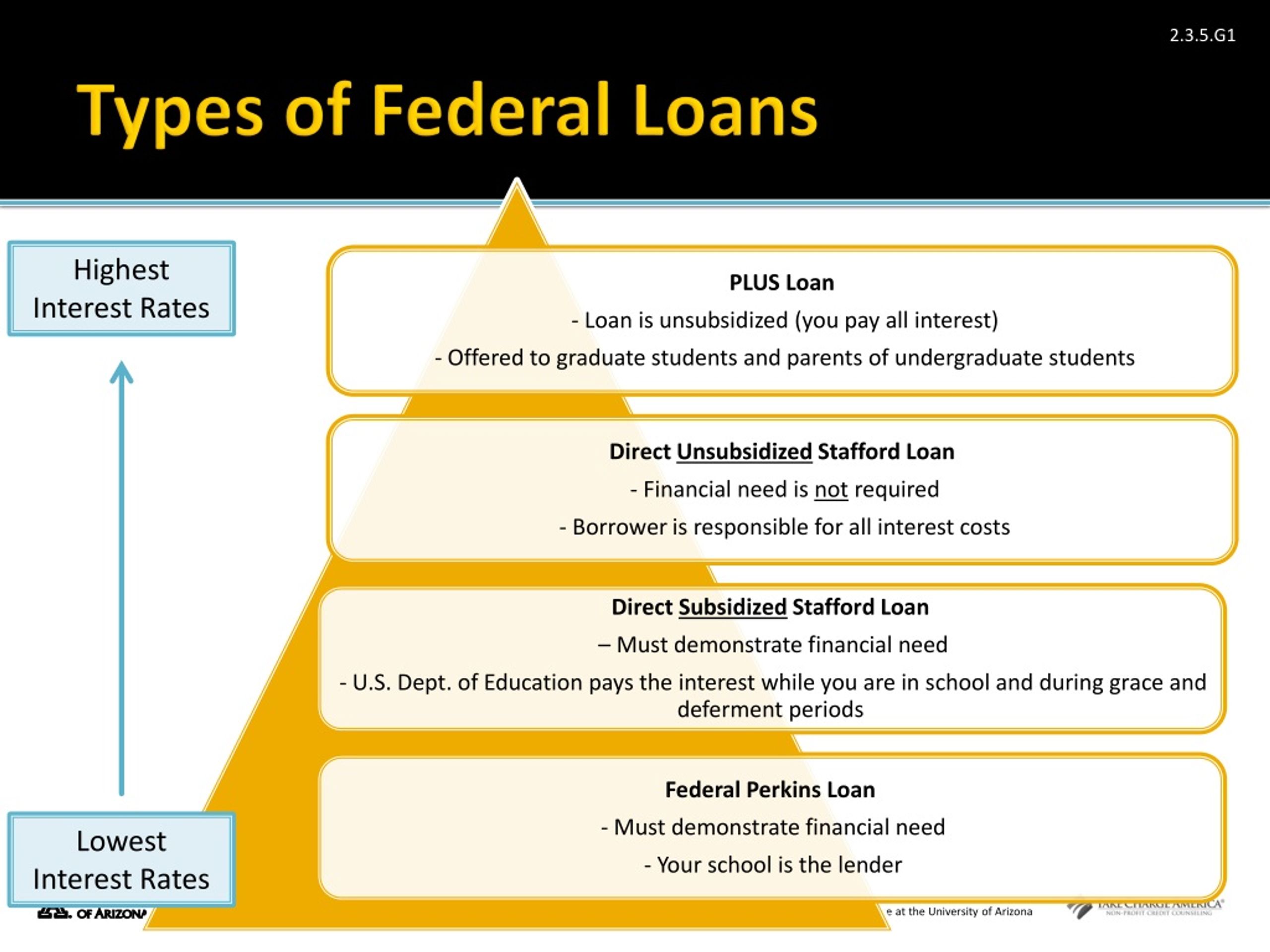

What Are The Types Of Student Loans

Types of Student Loans There are three types of student loans: federal loans, private loans, and refinance loans. To get federal loans, you must fill out the. If a student has a subsidized loan, the federal government will pay the interest for the loan while the student is actively enrolled in college courses. Student loans made by the federal government are commonly referred to as Direct Loans. There are four types of Direct Loans: Direct Subsidized Loans, Direct. Loans · Completing loan paperwork · Federal loans · Student loans program chart · Parent loans · Private loans · Short-term loans. Direct Loan interest rates are based on the high yield of the year Treasury note auctioned just prior to July 1st each year. While student loan interest. Options include grants, loans, scholarships, and work-study. Visit Types of Financial Aid on the Federal Student Aid website. You will learn about funding you. 1. Learn about different loan types Most students have two main options for student loans: federal (government) loans or private loans from banks, credit. The most common types of federal student loans are Direct Loans, Parent PLUS Loans, Graduate PLUS Loans, Stafford Loans, Consolidation Loans, Perkins Loans, and. Subsidized Stafford Loans are awarded to students who demonstrate financial need determined by filing the online Free Application for Federal Student Aid (FAFSA). Types of Student Loans There are three types of student loans: federal loans, private loans, and refinance loans. To get federal loans, you must fill out the. If a student has a subsidized loan, the federal government will pay the interest for the loan while the student is actively enrolled in college courses. Student loans made by the federal government are commonly referred to as Direct Loans. There are four types of Direct Loans: Direct Subsidized Loans, Direct. Loans · Completing loan paperwork · Federal loans · Student loans program chart · Parent loans · Private loans · Short-term loans. Direct Loan interest rates are based on the high yield of the year Treasury note auctioned just prior to July 1st each year. While student loan interest. Options include grants, loans, scholarships, and work-study. Visit Types of Financial Aid on the Federal Student Aid website. You will learn about funding you. 1. Learn about different loan types Most students have two main options for student loans: federal (government) loans or private loans from banks, credit. The most common types of federal student loans are Direct Loans, Parent PLUS Loans, Graduate PLUS Loans, Stafford Loans, Consolidation Loans, Perkins Loans, and. Subsidized Stafford Loans are awarded to students who demonstrate financial need determined by filing the online Free Application for Federal Student Aid (FAFSA).

Loans · Completing loan paperwork · Federal loans · Student loans program chart · Parent loans · Private loans · Short-term loans. The Department of Education currently offers three primary types of federal student loan programs: Direct Loans, Direct PLUS Loans, and Direct Consolidation. There are 2 types of Federal Direct Loans: Subsidized and Unsubsidized. Federal Direct Subsidized Student Loans, Federal Direct Unsubsidized Student Loans. A subsidized loan is your best option. With these loans, the federal government pays the interest charges for you while you're in college. Here are the types of. Federal Direct Subsidized Loans are interest-free while you're in college and have a borrowing limit that increases for each year of school you complete. There are two main types of student loans for college. Federal student loans offered by the federal government, and private student loans. Get straight. Federal student loans are broken down into four categories: Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans and Direct Consolidation Loans. Types of Federal Student Loans · Direct Subsidized Loans Available to undergrad students based on financial need. · Direct Unsubsidized Loans Available to. Borrowers should explore the different types of loans before entering into a loan agreement. It is important to exhaust all federal student aid before. Types of federal student loans · 1. Direct Subsidized Loans · 2. Direct Unsubsidized Loans · 3. Direct PLUS Loans. Federal Direct Student Loan · Subsidized: Need-based aid, for which the federal government pays the interest while the student is in school. · Unsubsidized: Not. Direct Subsidized Loans · Direct Unsubsidized Loans · Direct PLUS Loans, of which there are two types: Grad PLUS Loans for graduate and professional students, as. Aid is available from the federal government in the form of grants, work-study funds, and loans. Students use the Free Application for Federal Student Aid . Types of Federal Student Loans When you are enrolled at least half-time, you may qualify for either subsidized loans or unsubsidized loans from the Department. There are two kinds of student loans: Federal and private. They are treated differently and follow different rules. Knowing what kind of loan you have will. In the United States, student loans are a form of financial aid intended to help students access higher education. In , 70 percent of higher education. In the United States, student loans are a form of financial aid intended to help students access higher education. In , 70 percent of higher education. Independent student (Subsidized and Unsubsidized): $3, + $6, One Term (Fall, Spring, or Summer). Dependent student (Subsidized and Unsubsidized): $1, University Trust Fund Loan (UTFL). If you're an undergraduate who is enrolled full time, you may be offered a University Trust Fund Loan (UTFL) for an amount up.

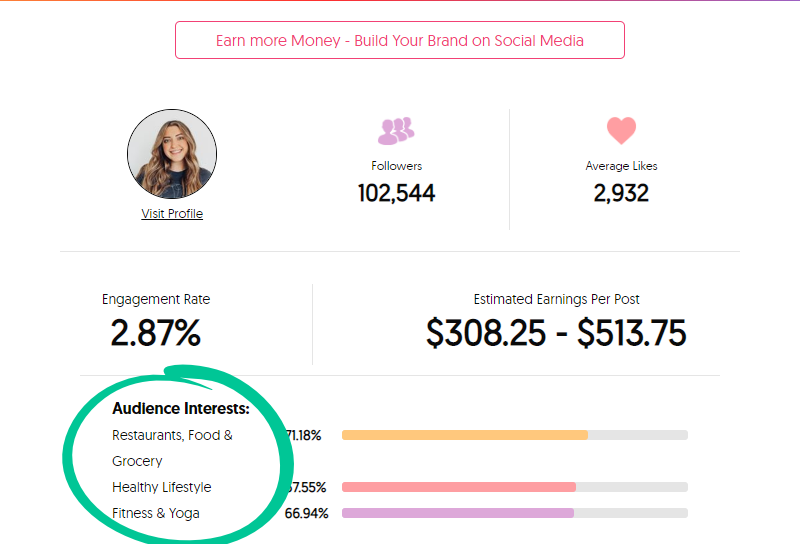

How Much Does Instagram Influencers Make

Celebrities on Instagram, who rank above mega influencers, can earn between Rs 7 to 15 lakh per video. In comparison, celebrity earnings on. The money on social media isn't limited to just Spiranac, the average influencer can earn $4, for a post on Instagram, while an average tour pro receives. However, micro influencers can also still make hundreds to thousands of dollars per post, too. Helping creators make a living on the platform has been a top. How does affiliate work? Instagram affiliate creators earn a commission on sales made from product tags in feed posts and Stories, and products featured in. According to a study, influencers with earn an average of $ per post. In most cases, micro-influencers don't charge upfront rather first. Instagram influencers can earn money from sponsored content, affiliate links, selling products or merchandise, getting tips, and more. On Instagram, the general pay rate rule of thumb is $ for every 10, followers. Influencers with extremely large followings, in the tens or hundreds of. Unlike becoming an influencer and getting paid per post, as an affiliate you get paid on commission. The average affiliate commission rate to expect is anywhere. For example, in , one influencer earned an average of $5, per month solely through affiliate connections. Stories and Earnings of Some Influencers. 1. Celebrities on Instagram, who rank above mega influencers, can earn between Rs 7 to 15 lakh per video. In comparison, celebrity earnings on. The money on social media isn't limited to just Spiranac, the average influencer can earn $4, for a post on Instagram, while an average tour pro receives. However, micro influencers can also still make hundreds to thousands of dollars per post, too. Helping creators make a living on the platform has been a top. How does affiliate work? Instagram affiliate creators earn a commission on sales made from product tags in feed posts and Stories, and products featured in. According to a study, influencers with earn an average of $ per post. In most cases, micro-influencers don't charge upfront rather first. Instagram influencers can earn money from sponsored content, affiliate links, selling products or merchandise, getting tips, and more. On Instagram, the general pay rate rule of thumb is $ for every 10, followers. Influencers with extremely large followings, in the tens or hundreds of. Unlike becoming an influencer and getting paid per post, as an affiliate you get paid on commission. The average affiliate commission rate to expect is anywhere. For example, in , one influencer earned an average of $5, per month solely through affiliate connections. Stories and Earnings of Some Influencers. 1.

In terms of salary, the national median salary for influencers was reported to be $45, Additionally, when examining job demand, employers across the country. Mega influencers $7,+ per post. Instagram Influencers. Instagram is the next best cost-effective channel for influencers. Here are the average prices based. Everyone who has ever tried a partnership with influential bloggers begins with measuring how much Instagram influencers cost. It all depends on the group the. How Much Does Instagram Influencer Marketing Cost? · 2, to 10, Instagram followers: $75 to $ per post · 10, to 50, Instagram followers: $ to. Most influencers fall into the nano category (1, to 10, followers) and earn $ to $ per sponsored post. Those with more followers can earn $5, or. They also make money through affiliate links, earning a commission for every sale they're responsible for. How much do influencers make a year? According to Vox. In sponsored posts, the influencer earns by promoting the brand on their social media channels. For example, brands may pay an influencer to post a photo of. Instagram Influencer Pricing: Start Here. A fair place to start is $ per 10k followers per post, according to Digiday. So, if an influencer has 60, How much does a Social Media Influencer make? As of Aug 17, , the average annual pay for a Social Media Influencer in the United States is $57, a year. Instagram posts ; Micro, $ – $8, ; Mid-tier, $8, – $20, ; Macro, $20, – $45, ; Mega/Celebrity, $45, +. 5. Instagram's Six-Figure Earners: · $, to $, Claimed by % of influencers. · $, to $1 million: Achieved by % of influencers. · $1 million. An Instagram Influencers in your area makes on average $17 per hour, or $ (%) more than the national average hourly salary of $ ranks number 1. Without a payout account, you can earn up to $ per monetization tool, with a maximum of $1, across 3 tools. If you haven't added a payout account. While your average influencer with a few hundred thousand followers may earn anywhere from $$ per campaign. Then there's also brand ambassadorship. This. Earnings in this industry can be quite lucrative, with micro-influencers earning between $ and $1, per sponsored post. Influencers with. Overall, the average of earnings for influencers is about $35, a year, according to a report from HypeAuditor, a provider of marketing tools for social. For example, if you earn about $ and have 37, views on your Facebook Reels video content, you can estimate you have earned about $ per 1, views. According to a recent report on influencer salary, one-quarter of influencers earned between $50, and $, in This makes it the income range earned. Gabby makes hundreds of thousands of dollars from her content, netting nearly $, in Top Instagram influencers reported earning as much as $92,

How To Get The Free Version Of Turbotax

Find paid tax software with free offerings ; TurboTax Free for iPhone, iPad, , Mobile app ; eFile Canadian Tax Return (Apple), , Mobile app ; UFile. Yes, TaxSlayer Simply Free includes a totally free federal return for those who qualify. If not, you have several other options with varying levels of support. If you have a Form return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition. To qualify for free TurboTax from Fidelity, ensure that you have the necessary tax forms required for accurate tax filing. This includes forms for claiming. TurboTax estimates more than one in three tax filers can use its free online edition. But this version has minimal assistance, and you can only use it with. What's TurboTax Live? With TurboTax Live Self-Employed, simple click to connect to a real tax expert, when you need them, for ultimate convenience. You'll get. You can use Free Edition by selecting Tax Tools in the left menu, then Switch to Free Edition. Selecting this option keeps all the data you've entered so far. Just simple tax returns (including taxpayers with only W-2 income) qualify for TurboTax Free Edition; Processing state tax returns generally costs extra. If you have a Form return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition or TurboTax Live Assisted Basic. Find paid tax software with free offerings ; TurboTax Free for iPhone, iPad, , Mobile app ; eFile Canadian Tax Return (Apple), , Mobile app ; UFile. Yes, TaxSlayer Simply Free includes a totally free federal return for those who qualify. If not, you have several other options with varying levels of support. If you have a Form return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition. To qualify for free TurboTax from Fidelity, ensure that you have the necessary tax forms required for accurate tax filing. This includes forms for claiming. TurboTax estimates more than one in three tax filers can use its free online edition. But this version has minimal assistance, and you can only use it with. What's TurboTax Live? With TurboTax Live Self-Employed, simple click to connect to a real tax expert, when you need them, for ultimate convenience. You'll get. You can use Free Edition by selecting Tax Tools in the left menu, then Switch to Free Edition. Selecting this option keeps all the data you've entered so far. Just simple tax returns (including taxpayers with only W-2 income) qualify for TurboTax Free Edition; Processing state tax returns generally costs extra. If you have a Form return and are claiming limited credits only, you can file for free yourself with TurboTax Free Edition or TurboTax Live Assisted Basic.

It searches for hundreds of deductions and credits and handles even the toughest tax situations, so you can be confident you're getting every dollar you deserve. TurboTax Free Edition: TurboTax Free Edition ($0 Federal + $0 State + $0 To File) is available for those filing Form and limited credits only, as detailed. tax software when they thought they were receiving a free version. However Get Kiplinger Today newsletter — free. Profit and prosper with the best. Download the H&R Block Tax Prep app Upload documents and do taxes at your own pace. Download on the App Store Get it on Google Play. Since Intuit has exited the IRS Free File program, we no longer offer IRS Free File Program delivered by TurboTax, formerly known as TurboTax Free File Program. While you can start any TurboTax product for free, it's hard to automatically downgrade from any of the paid versions back to the Free Edition. Because of this. Simply connect MyCRA account and your Canadian tax slips will be automatically uploaded into TurboTax. 2. Easy access to a team of Canadian tax experts to. Roughly 37% of taxpayers are eligible. If you have a Form return and are claiming limited credits only, you can file for free yourself with TurboTax Free. find, even through search engines, and that it deceptively steered individuals who search for the free version to TurboTax versions that cost money to use. Saving money. Getting the maximum refund you deserve. Block understands these things mean a lot to you. That's why it's important to compare your options. Taxpayers whose AGI is $79, or less qualify for a free federal tax return. Free File Fillable Forms are electronic federal tax forms, equivalent to a paper. Get your maximum refund and file your federal return for free. Add a state FreeTaxUSA is a great alternative to high priced tax software such as TurboTax and. E-file your federal and state taxes online with TaxAct. Explore tax products for a wide range of tax filing situations and get your maximum tax refund. Except for bushiken.ru, if you sign up with the free option at H&R Block®, TurboTax®, or credit card based tax preparation sites, you will soon find out that you. find, even through search engines, and that it deceptively steered individuals who search for the free version to TurboTax versions that cost money to use. Do you qualify for the Earned Income Credit? • Whats EIC? • Are you active duty military (reserves, nation guard) and have an AGI of less than $69,? Intuit. Your experience can help others make better choices Claim your profile to access Trustpilot's free business tools and connect with customers. Get free. For US returns, go to bushiken.ru, and click on “free file". Based on your situation, it will refer you to vendors who will allow you to use. % free federal tax filing. E-File your tax return directly to the IRS. Prepare federal and state income taxes online. tax preparation software.

How Much Tax On Self Employed Income

The self-employment tax rate is % (% for Social Security tax and % for Medicare). The self-employment tax applies to your adjusted gross income. If. That amount is a total of %, with % of it dedicated to Social Security and % dedicated to Medicare. 2. How much do I owe in self employment tax to. Self-employed individuals are responsible for paying both portions of the Social Security (%) and Medicare (%) taxes. Do I have to pay Self-Employment. The short answer is no. If your passive income is defined as such by the IRS, then it isn't subject to self-employment tax (although it will likely be subject. Once you know your net earnings, you can calculate your self-employment tax. The current rate of self-employment tax is %. This means that you'll multiply. That amount is %, comprising % for Social Security, old-age, survivors, and disability insurance, and % for Medicare or hospital insurance. 2. How. You must pay % in Social Security and Medicare taxes on your first $68, in self-employment earnings, and % in Medicare tax on the remaining $1, in. Your net earnings from self-employment were $ or more, or; You had church employee income of $ or more. If you earned enough self-employment income. This accounts for the fact that you only pay self-employment tax on % of your net earnings. (You use this percentage since employees pay half of Social. The self-employment tax rate is % (% for Social Security tax and % for Medicare). The self-employment tax applies to your adjusted gross income. If. That amount is a total of %, with % of it dedicated to Social Security and % dedicated to Medicare. 2. How much do I owe in self employment tax to. Self-employed individuals are responsible for paying both portions of the Social Security (%) and Medicare (%) taxes. Do I have to pay Self-Employment. The short answer is no. If your passive income is defined as such by the IRS, then it isn't subject to self-employment tax (although it will likely be subject. Once you know your net earnings, you can calculate your self-employment tax. The current rate of self-employment tax is %. This means that you'll multiply. That amount is %, comprising % for Social Security, old-age, survivors, and disability insurance, and % for Medicare or hospital insurance. 2. How. You must pay % in Social Security and Medicare taxes on your first $68, in self-employment earnings, and % in Medicare tax on the remaining $1, in. Your net earnings from self-employment were $ or more, or; You had church employee income of $ or more. If you earned enough self-employment income. This accounts for the fact that you only pay self-employment tax on % of your net earnings. (You use this percentage since employees pay half of Social.

The self-employment tax rate is %, of which % goes to Social Security and % goes to Medicare. Income tax obligations vary based on net business. Medicare Tax: This levy applies no matter how much you make. Plus, you must pay an additional % Medicare tax if your income exceeds $, (single, head of. Self-employed individuals must file a tax return if their net earnings are at least $ Unlike traditional employees, who have taxes automatically withheld. Enter your estimated weekly or monthly profit to get an idea of how much Income Tax and Class 4 National Insurance you'll pay. The estimate you get will be. Self-employed workers are taxed at % of their net profit. This percentage is a combination of Social Security (%) and Medicare (%) taxes, also known. Since self employed folks don't have this amount automatically withdrawn from their income, they must file their Schedule SE, or Form The current. Unlike many other tax types, the self-employment tax does not depend on your income bracket. Therefore, the amount is even for everyone who is self-employed or. This is calculated by taking your total 'net farm income or loss' and 'net business income or loss' and multiplying it by %. This is done to adjust your. The self-employment tax rate is currently, approximately %. This rate consists of the two parts mentioned above. Medicare taxes are (%) of earned income. Is self-employment tax the same as income tax? No, these two taxes are not the same. Self-employment tax is a federal Social Security and Medicare tax imposed. Self-employed people pay up to % in federal self-employment taxes—this is because you'll need to pay your Social Security and Medicare taxes as both the. This means you'll pay % in self-employment taxes—% for Social Security on income up to the taxable earnings limit and % for Medicare with no income. Enter your self-employment income in order to figure out how much you'll pay in social security and mediacare tax. You should expect to pay about $8, in. Most self-employed individuals end up in the % income tax range, with most people having an average (or “effective”) tax rate of around 14%. (You can read. The IRS set the self-employment tax rate at percent. That rate is the sum of two parts: A % Social Security tax rate and a % Medicare tax rate. Your. The self-employment tax rate is %, of which % goes to Social Security and % goes to Medicare. Income tax obligations vary based on net business. And while W-2 employers and their employees split the tax (% and %), self-employed people are on the hook for the whole %. Income tax. Income tax is. Self-employment tax is calculated by multiplying your income by the self-employment tax rate (%), which includes both the Social Security and Medicare. New York has a graduated income tax for individuals, ranging from percent to percent based on your income. Keep in mind that local jurisdictions may. In , income up to $, is subject to the % tax paid for the Social Security portion of self-employment taxes (FICA). Your employment wages and tips.

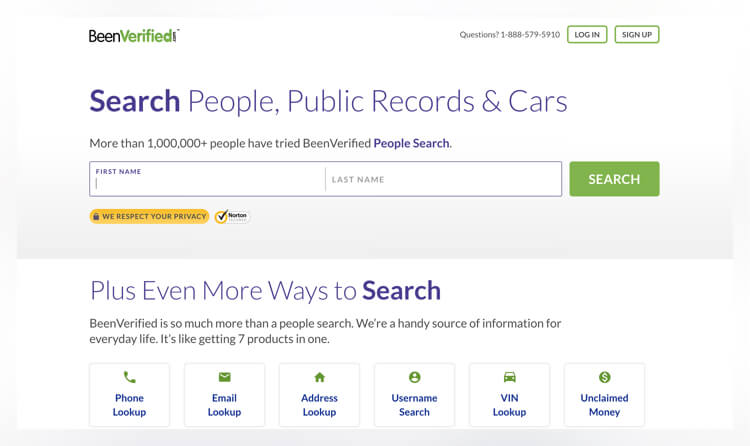

Real Background Check Website

8 Totally Free Background Check Websites · 1. US Search. Let's start our list with US Search. · 2. TruthFinder. Moving on, let's talk about. The only free online directory and portal dedicated to helping you find online public records and run an online background check. Checkr platform uses AI to make background screening more efficient, speed up the hiring process, fill roles faster & drive more revenue. ✓ Start for free! National/FBI fingerprint based background checks are available for persons with specific access authorization to National/FBI record checks under state or. Get fast, thorough background checks from the best-recognized provider in the industry. Protect your company and your customers against hiring the wrong people. Other OptionsN.C. State Bureau of Investigation (SBI) Statewide Background Check for YourselfThe SBI provides a non-certified, statewide criminal record search. There are numerous sites —FirstAdvantage, Checkr, Intelius — that will run criminal background checks for a fee. The state where I live allows. BCI completes such background checks by comparing fingerprints received against a database of criminal fingerprints to determine if there is a criminal record. Service and technology for better employment background checks. Accurate offers optimized screening programs to fit your company's needs. 8 Totally Free Background Check Websites · 1. US Search. Let's start our list with US Search. · 2. TruthFinder. Moving on, let's talk about. The only free online directory and portal dedicated to helping you find online public records and run an online background check. Checkr platform uses AI to make background screening more efficient, speed up the hiring process, fill roles faster & drive more revenue. ✓ Start for free! National/FBI fingerprint based background checks are available for persons with specific access authorization to National/FBI record checks under state or. Get fast, thorough background checks from the best-recognized provider in the industry. Protect your company and your customers against hiring the wrong people. Other OptionsN.C. State Bureau of Investigation (SBI) Statewide Background Check for YourselfThe SBI provides a non-certified, statewide criminal record search. There are numerous sites —FirstAdvantage, Checkr, Intelius — that will run criminal background checks for a fee. The state where I live allows. BCI completes such background checks by comparing fingerprints received against a database of criminal fingerprints to determine if there is a criminal record. Service and technology for better employment background checks. Accurate offers optimized screening programs to fit your company's needs.

The Missouri Automated Criminal History Site (MACHS) is Missouri's one-stop website for all criminal background check needs. This site is administered by. Resources & Questions · Who Can Request Criminal History Reports? · Obtaining a Background Check Online (WATCH) · Obtaining a Background Check By Mail · Obtaining a. Checkr platform uses AI to make background screening more efficient, speed up the hiring process, fill roles faster & drive more revenue. ✓ Start for free! We offer the fastest, easiest and most secure way to complete background checks on prospective hires. Get fast, thorough background checks from the best-recognized provider in the industry. Protect your company and your customers against hiring the wrong people. Checkr platform uses AI to make background screening more efficient, speed up the hiring process, fill roles faster & drive more revenue. ✓ Start for free! background check. Online. The fastest option is to submit your request online, for both Identity History Summary Checks and Identity History Summary Challenges. HireRight is a leading global provider of on-demand employment background checks, drug testing, Form I-9 and employment and education verifications. Accurate Background LLC, is committed to helping the survivors of human trafficking. To request to block adverse information from your background screening. FastCheck is an online portal for obtaining criminal record reports. You have two (2) online options: FastCheck lets registered users order criminal record. background check. Online. The fastest option is to submit your request online, for both Identity History Summary Checks and Identity History Summary Challenges. Start a Free Background Check Online with bushiken.ru Obtain a Free Public Background Check Report in Just Minutes. The Wisconsin Online Record Check System is designed for individuals or organizations to submit criminal background checks and retrieve results online. The Alabama Background Check System (ABC) is a secure, web-based site that allows qualifying employers to access the most up to date, comprehensive Alabama. TBI allows the general public to obtain a Tennessee adult criminal history on any individual. The process may be completed online or by mail. Background check. The State Bureau of Investigation provides a finger-print-based NC-criminal history background check. This is also known as your “Right to Review” your North. Conducting pre-employment background checks is crucial in finding the right person for the job.✓ Sterling background checks are fast, accurate and. It looks like Intelius acquired several other background check services, such as Bothell, Family Builder, and bushiken.ru It's widely considered one of the. Use the Pennsylvania Access to Criminal History (PATCH) site for the fastest response, but mail-in service is also available. An official website of the State of Maryland If you are seeking employment or to be licensed within Maryland, your employer or licensing agency must request.

Calculate Mortgage Budget

To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. How much house can I afford based on my salary? Take account of your financial readiness to buy a house by applying the 28/36 rule. Lenders generally want to. Use this calculator to estimate how much house you can afford with your budget. Your total housing costs should not be more than 28% of your gross monthly income. Your total debt payments should not be more than 36%. Debt-to-income-ratio . Determine your monthly payments using our purchase budget calculator. Set your purchase budget using your household income, monthly debts, and more! What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. The other ratio involves all of your loan payments – your housing expenses (including any HOA fees, if applicable) and your total monthly debts (but not. Calculate your mortgage preapproval amount with this home loan affordability calculator. See what you can afford based on your income and expenses. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. How much house can I afford based on my salary? Take account of your financial readiness to buy a house by applying the 28/36 rule. Lenders generally want to. Use this calculator to estimate how much house you can afford with your budget. Your total housing costs should not be more than 28% of your gross monthly income. Your total debt payments should not be more than 36%. Debt-to-income-ratio . Determine your monthly payments using our purchase budget calculator. Set your purchase budget using your household income, monthly debts, and more! What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. The other ratio involves all of your loan payments – your housing expenses (including any HOA fees, if applicable) and your total monthly debts (but not. Calculate your mortgage preapproval amount with this home loan affordability calculator. See what you can afford based on your income and expenses.

Under this formula, a person earning $, per year can only afford a mortgage of $, to $, However, this calculation is only a general guideline. Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use. PNC's free mortgage affordability calculator allows you to estimate how much house you can afford based on income or payment and other debts or expenses. To calculate this percentage, multiply your gross monthly income by For example, if your gross monthly income is $5,, your housing expenses should not. Mortgage affordability calculator Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. Our calculator estimates what you can afford and what you could get prequalified for. Why? Affordability tells you how ready your budget is to be a homeowner. More about this calculator · Gross income. Your total monthly income before taxes and other deductions. · Down payment. The amount of cash a borrower pays. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give you. Should you rent or buy? Calculate your monthly mortgage payment · Compare Ideally, every dollar of your income should be accounted for in a monthly budget. By monthly payment – Enter the amount you're comfortable paying for your mortgage each month and the size of your down payment. We'll tell you the sum you can. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Do the basic math. First, do a quick calculation to get a rough estimate of how much you can afford based on your income alone. Most financial advisors. calculator to determine how much house you can afford. Enter your income, monthly debt, and down payment to find a home within your budget. Find out how much house you can afford with our home affordability calculator. See how much your monthly payment could be and find homes that fit your. To calculate your DTI ratio, divide your monthly debt payments by your monthly gross income and multiply by For example, if you pay $2, toward your debt. Calculate how much house you can afford using our award-winning home affordability calculator. Find out how much you can realistically afford to pay for. Mortgage Affordability Calculator Explore how much house you can afford by entering your annual income or a fixed monthly payment. To receive the most. Use this mortgage calculator to estimate how much house you can afford. See your total mortgage payment including taxes, insurance, and PMI. Chart displaying what you ideally should spend on expenses, your mortgage, and debt every. Your mortgage and your overall budget. The question isn't how much. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of.

Costa Rica Sports Betting

Bet CRIS Sportsbook provides Safe, Legal, and Secure sports betting on sporting events, as well as horse racing, online casino games, poker, and bingo. AnyBet is a Premier Online Betting Website in Jamaica. Bet on Sports, Global Numbers, Instant Games, Betgames and More Costa Rica, Liga de Ascenso, Apertura. Sportsbooks in Costa Rica are always in the sights of US law enforcement despite being legal here. Costa Rica First Division Odds – Bet Costa Rican Soccer Betting Lines Odds as well as daily, weekly & monthly Sports Betting bonus offers. Looking for. In this guide, we will cover numerous best sportsbooks that accept Costa Rican players. So players can choose a sports betting site based on their preferences. I ran a website for years out of Costa Rica and took bets locally nfl sports betting picks, sports picks and betting, pick of the. Elevate your soccer betting with Costa Rica Primera División odds and lines. Bet on captivating games, explore the latest odds and bet with excitement at. Costa Rica - Primera Div Odds DraftKings Inc. We are regulated by the New Jersey Division of Gaming Enforcement as an Internet gaming operator in accordance. Get the latest betting odds & lines for COSTA-RICA Soccer at BetOnline Sportsbook for betting on your favorite sport and snag a huge sign-up bonus. Bet CRIS Sportsbook provides Safe, Legal, and Secure sports betting on sporting events, as well as horse racing, online casino games, poker, and bingo. AnyBet is a Premier Online Betting Website in Jamaica. Bet on Sports, Global Numbers, Instant Games, Betgames and More Costa Rica, Liga de Ascenso, Apertura. Sportsbooks in Costa Rica are always in the sights of US law enforcement despite being legal here. Costa Rica First Division Odds – Bet Costa Rican Soccer Betting Lines Odds as well as daily, weekly & monthly Sports Betting bonus offers. Looking for. In this guide, we will cover numerous best sportsbooks that accept Costa Rican players. So players can choose a sports betting site based on their preferences. I ran a website for years out of Costa Rica and took bets locally nfl sports betting picks, sports picks and betting, pick of the. Elevate your soccer betting with Costa Rica Primera División odds and lines. Bet on captivating games, explore the latest odds and bet with excitement at. Costa Rica - Primera Div Odds DraftKings Inc. We are regulated by the New Jersey Division of Gaming Enforcement as an Internet gaming operator in accordance. Get the latest betting odds & lines for COSTA-RICA Soccer at BetOnline Sportsbook for betting on your favorite sport and snag a huge sign-up bonus.

While there are gambling operations scattered around the Caribbean, Costa Rica currently ranks as the hub, housing anywhere from to sports books . Costa Rica does not have a specific Gambling License. However, companies must register as a legal entity and comply with general legislation, including AML/CFT. Bet on futures for Costa Rica with live odds at Bovada Sportsbook USA! Join now and get a welcome bonus for your Costa Rica soccer bets! Online sports betting is legal in all seven provinces of Costa Rica. Brick-and-mortar sports betting isn't legal in any of them, but with the wide array of. Whether you're a seasoned sports bettor or a curious newcomer, come on down to Crocs Resort & Casino and experience the excitement of live sports betting today! Sportsbooks in Costa Rica are always in the sights of US law enforcement despite being legal here. Whether you're a sports betting shop, gaming cabinet manufacturer or Costa Rica, Cote D'Ivoire (Ivory Coast), Croatia (Hrvatska), Cyprus, Czech. No, there is not. While people refer to a Costa Rica gaming license, it doesn't exist and there are no laws or regulations for online gambling in Costa Rica. View the latest odds for Soccer in Costa Rica on Stake. Instantly deposit and withdraw BTC, ETH, Doge, & more. Ultimate Sports Betting Experience on Stake. In Costa Rica, there is no regulatory framework and no supervising authority dedicated solely to gambling businesses. Local government authorities . The wait for the events in Costa Rica is almost over! Find out BetMGM's latest Soccer odds for the events and place your wager today. TGM Global Gambling and Sports Betting Survey provide insights into gambling behavior and statistics worldwide. The Online Sports Betting market in Costa Rica is projected to grow by % () resulting in a market volume of US$m in The first thing to say is that gambling is legal in Costa Rica. It's important to note, though, that the legal landscape governing casinos and gambling is. Bet on soccer games in Costa Rica with live odds at Bovada Sportsbook USA! Join now and get a welcome bonus for your Costa Rica soccer bets! Costa Rica International Sports (CRIS Sportsbook) has been a sports betting Bet CRIS Sportsbook provides Safe, Legal, and Secure sports betting on sporting. Costa Rica, Latvia, and Panama to set up online sportsbooks that target American customers. These sportsbooks are illegal in the United States and prey on. Compare Football Costa Rica Betting Odds, on all games played in all leagues. Stay updated with Odds Portal. Find the latest Costa Rican Primera Division Schedule betting odds at FanDuel Sportsbook. Sign up now to bet on Costa Rican Primera Division with America's. Of course, sports betting is legal in Costa Rica. It also follows the appropriate protocols such as the sports betting regulation, licensing, and other.

Morningstar Stylebox

The Morningstar U.S. Equity Style BoxTM is a grid that provides a graphical representation of the investment style of stocks and portfolios. We explain why Morningstar “style drift” often just reflects the Drift myth and the influence of active management on Morningstar's style box. Designed to accurately represent the size and style dimensions of the U.S. equity market in alignment with the Morningstar Style Box™, the Morningstar®. The Morningstar Style Box is a visual tool that helps investors see past confusing fund names and descriptions to better understand the “investment style” of. style. Over a period of time, the shape and location of a fund's ownership zone may vary. The Morningstar Style BoxTM reveals a fund's investment strategy. style boxes are recalculated on a monthly basis. For the Pros. How Morningstar Measures Average Weighted Maturity. The average term length of a fund's bond. The Morningstar Style BoxTM was introduced in to help investors and advisors determine the investment style of a fund. The Style Box is a nine-square grid. The Morningstar Style Box is a nine-square grid that provides a graphical representation of the "investment style" of equities and mutual funds. For equities. The Mutual Fund Style Box categorizes funds on the basis of market capitalization and investment style. Morningstar, Inc., a mutual fund research company that. The Morningstar U.S. Equity Style BoxTM is a grid that provides a graphical representation of the investment style of stocks and portfolios. We explain why Morningstar “style drift” often just reflects the Drift myth and the influence of active management on Morningstar's style box. Designed to accurately represent the size and style dimensions of the U.S. equity market in alignment with the Morningstar Style Box™, the Morningstar®. The Morningstar Style Box is a visual tool that helps investors see past confusing fund names and descriptions to better understand the “investment style” of. style. Over a period of time, the shape and location of a fund's ownership zone may vary. The Morningstar Style BoxTM reveals a fund's investment strategy. style boxes are recalculated on a monthly basis. For the Pros. How Morningstar Measures Average Weighted Maturity. The average term length of a fund's bond. The Morningstar Style BoxTM was introduced in to help investors and advisors determine the investment style of a fund. The Style Box is a nine-square grid. The Morningstar Style Box is a nine-square grid that provides a graphical representation of the "investment style" of equities and mutual funds. For equities. The Mutual Fund Style Box categorizes funds on the basis of market capitalization and investment style. Morningstar, Inc., a mutual fund research company that.

A new research framework for evaluating liquid alternatives investments that will be available to Morningstar Direct clients at the end of October. Previous methodology used Annual. Report financial data. • Morningstar's equity database has improved in coverage and quality since the last major changes made. Source: Morningstar®. The style box reveals a fund's investment style. The vertical axis shows the market capitalization of the stocks owned and the. Expense ratios are shown below the ticker symbols. Large. Mid. Small. Value Blend Growth. The new style box. Modernize the traditional style box. Morningstar. Learn more about the Morningstar Style Box, which reveals a fund's investment strategy, and can be used for both equity funds and fixed-income funds. Mr. Silveira said Morningstar's style boxes are not part of his core approach to building client portfolios but he does use them in specific situations. “If. What is the Morningstar Style Box? A desire to help investors choose funds based on what they really own – instead of on what funds call themselves, how they. glossary Fund Portfolio. Morningstar Style Box™. Equity. Size Style. Fixed Income. Credit Quality Interest Rate Sensitivity. Total Net Assets (EUR). 0. 1. Overview Morningstar investment style box method (Morningstar Style Box) was founded in to help investors analyze the investment style of the fund. Morningstar's original style evaluation methodology was designed primarily for categorizing equity mutual funds. The new style evaluation methodology introduces. The style box is a nine-square grid with a horizontal and vertical axis and was designed by financial services researcher Morningstar, Inc. Investors can use. Morningstar Style Box · How It Works The vertical axis of the Style Box defines three size categories, or capitalization bands-small, mid-size, and large. The Morningstar style box is a nine-square grid used to determine the investment philosophy of equities and mutual funds. The Morningstar Style Box is a nine-square grid that categorizes stocks and mutual funds based on their market capitalization and investment style. The. The Morningstar Style Box was introduced in to help investors and advisors determine the investment style of a fund. Different investment styles often. Morningstar equity style box and sector allocations: I would be interested if members could share their Morningstar style box and sector split and welcome. Portfolio includes Morningstar's style box, asset allocation, sector weightings, world regions, market capitalization, and valuation measures. Purchase. There is a simple remedy to these problems: Treat the style box as a crude simplification of a messy reality. Understand that the style box's definition of. Morningstar Style Box™. The Morningstar Style Box™ reveals a fund's investment strategy. For equity funds the vertical axis shows the market capitalization.

Blackrock Ishares S&P 500 Index Fund

- EDITED-p-500.jpg)

Under normal circumstances, the fund invests at leas. Chart for Ishares S&p Index Fund - Institutional BSPIX. BSPIX iShares S&P Index Instl Fund Class Information. Class Name, Ticker. BlackRock S&P Stock. iShares Core S&P funds offer well-diversified, market-cap-weighted portfolios of of the largest US stocks. The fund aims to provide investors with the performance of the S&P ® Index, before fees and expenses. The index is designed to measure the performance of. BlackRock's iShares Core S&P ETF also pays out dividends, but only a How Does an S&P ETF Differ from an S&P Index Fund? Both an index. Jennifer Hsui, Managing Director & Portfolio Manager at BlackRock Investment Management LLC has been employed by BlackRock Fund Advisors as a senior portfolio. The Fund aims to achieve a return on your investment, through a combination of capital growth and income on the Fund's assets. At least 90% of the value of the fund's assets is invested in securities comprising the S&P Index. BlackRock's ETF and Index Investments group. Mr. The iShares S&P Index ETF seeks to provide long-term capital growth by replicating, to the extent possible, the performance of the S&P Index. Under normal circumstances, the fund invests at leas. Chart for Ishares S&p Index Fund - Institutional BSPIX. BSPIX iShares S&P Index Instl Fund Class Information. Class Name, Ticker. BlackRock S&P Stock. iShares Core S&P funds offer well-diversified, market-cap-weighted portfolios of of the largest US stocks. The fund aims to provide investors with the performance of the S&P ® Index, before fees and expenses. The index is designed to measure the performance of. BlackRock's iShares Core S&P ETF also pays out dividends, but only a How Does an S&P ETF Differ from an S&P Index Fund? Both an index. Jennifer Hsui, Managing Director & Portfolio Manager at BlackRock Investment Management LLC has been employed by BlackRock Fund Advisors as a senior portfolio. The Fund aims to achieve a return on your investment, through a combination of capital growth and income on the Fund's assets. At least 90% of the value of the fund's assets is invested in securities comprising the S&P Index. BlackRock's ETF and Index Investments group. Mr. The iShares S&P Index ETF seeks to provide long-term capital growth by replicating, to the extent possible, the performance of the S&P Index.

Get BSPIX mutual fund information for BlackRock-S&PIndex-Fund-Institutional-Shares, including a fund overview,, Morningstar summary, tax analysis. vs. Benchmark. IVV. iShares Core S&P ETF. Family. iShares from BlackRock. Category. Large Blend. Fund is invested in military contractors above the threshold of % and below the threshold of 4%. Assigned a grade of D. Find our live Ishares S&p Index Fund Class K fund basic information. View & analyze the WFSPX fund chart by total assets, risk rating, Min. investment. The Fund seeks to provide investment results that correspond to the total return performance of publicly-traded common stocks in the aggregate, S&P Index. Sustainability Rating. Key Data. BlackRock. Issuer. S&P Benchmark. B. Net Asset. USD. Currency. %. TER. 07/30/ Inception. Yes. Distributing. BlackRock Fund Advisors 55 East 52nd St New York, NY Website. bushiken.ru Fund Details. Fund TypeOpen-End Fund. ObjectiveBlend Large Cap. Asset. iShares S&P Index Fund WFSPX has $ BILLION invested in fossil fuels, % of the fund. iShares S&P Index Fund - Class K (WFSPX) - Price and Analysis - mutual blackrock funds iii. Dividend Yield. (%). CategoryEquity. Total. iShares S&P Index Investor P (BSPPX) is a passively managed U.S. Equity Large Blend fund. BlackRock launched the fund in The investment seeks to. iShares S&P Index K Overview BlackRock / Large Blend The fund is a "feeder" fund that invests all of its assets in the Master Portfolio of MIP, which has. iShares S&P Index Fund performance, holdings, fees, risk and other BlackRock Technology Opportunities Fund. %. 1-YEAR. Technology. Search Funds. iShares Core S&P ETF · All funds All funds · College Savings Plan These funds provide exposure to U.S. equities. BSPAX · iShares S&P Index Fund. Refer to bushiken.ru for current month-end performance. Index performance is shown for illustrative purposes only. It is not possible to invest directly in an. MIP is an open-end, series management investment company. BlackRock Fund Advisors (“BFA” or the “Manager”) serves as investment adviser to the Master Portfolio. Investment Objective. iShares S&P Index Fund (the “Fund”), a series of BlackRock Funds III (the “Trust”), seeks to provide investment results that. The investment seeks to provide investment results that correspond to the total return performance of publicly-traded common stocks in the aggregate. BlackRock Funds III - BlackRock S&P Index Fund is a feeder fund launched by BlackRock, Inc. The fund is managed by BlackRock Fund Advisors. Analyze the Fund iShares S&P Index Fund Investor A Shares having Symbol BSPAX for type mutual-funds and perform research on other mutual funds. iShares S&P Index Fund · 1. Microsoft Corp. Prison industry Border industry. $B % · 2. bushiken.ru Inc. Prison industry Border industry. $B %.

1 2 3 4 5